Supporting Your Business Through Difficulties

If your business has been impacted by financial difficulties, TaxDebts can help you face your challenges and identify new opportunities.

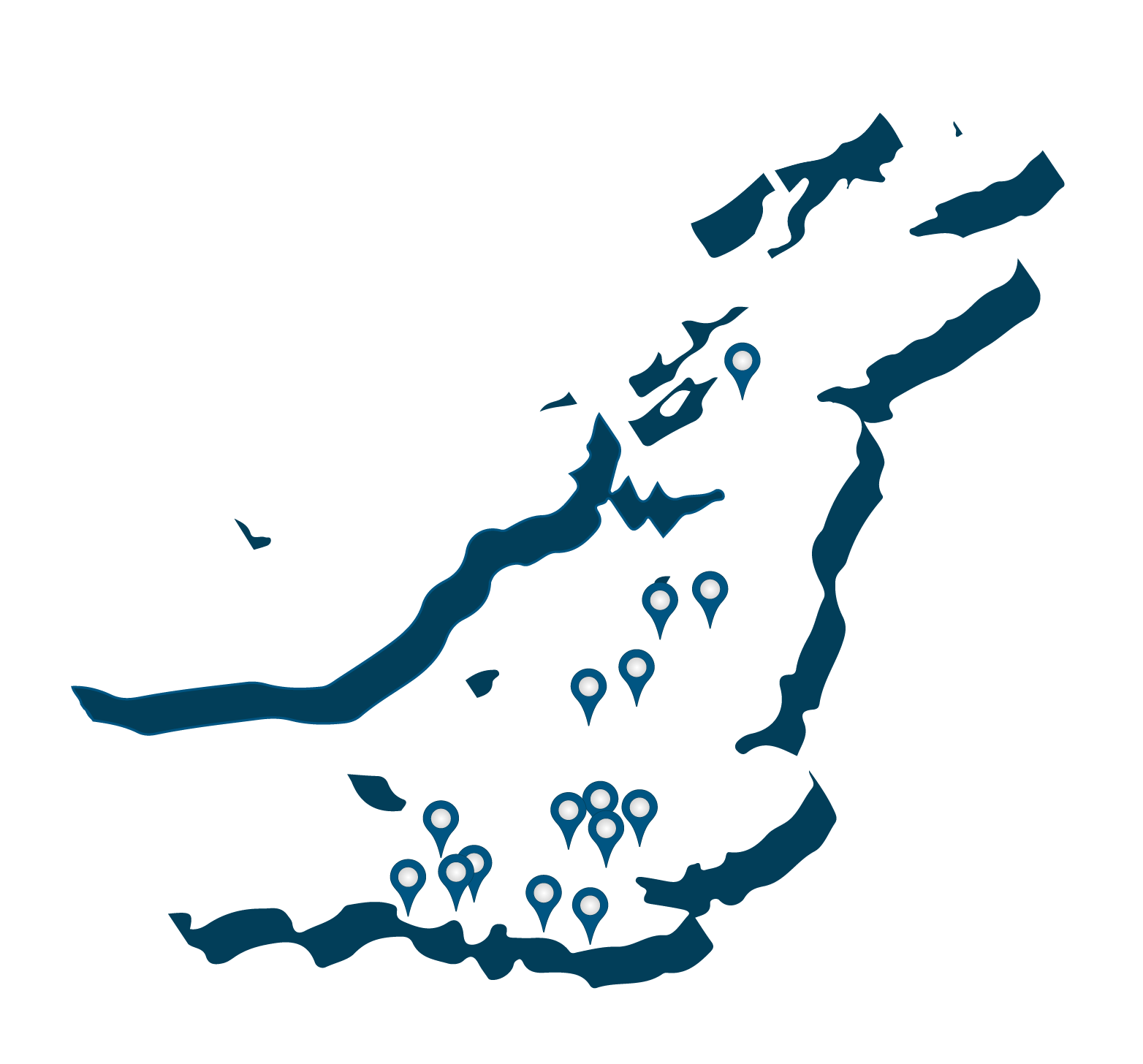

Our Offices

At TaxDebts, we are committed to giving our clients a personal service when it comes to our tax and insolvency advice.

That is why we have 15 offices spread across the length and breadth of the UK – meaning you will never be too far away from our expert support. This is just another example of our commitment to be there for our clients whenever we are needed.

London

Manchester

Birmingham

Southampton

Watford

Bristol

Marlow

Brighton

Ringwood

Bradford

Eastbourne

Chelmsford

Nottingham

Weymouth

Glasgow