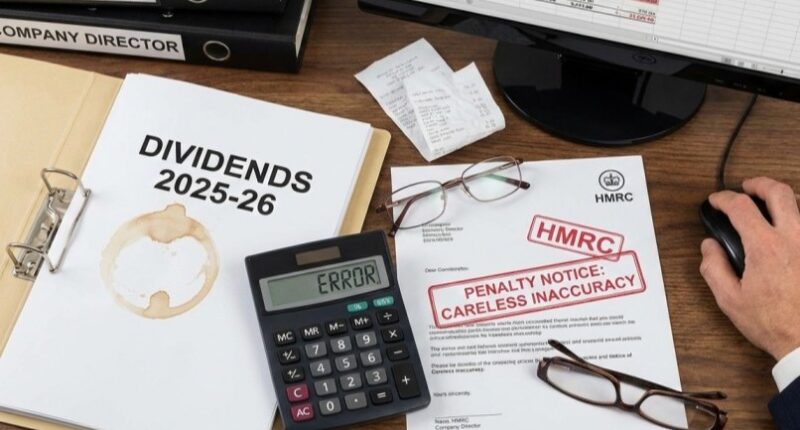

HMRC directors’ penalties apply to many company directors, even for unintentional mistakes. While some believe fines only target deliberate tax evasion, careless errors remain the most common reason directors are penalised in 2026.

HMRC continues to penalise directors for unintentional mistakes that result in underpaid tax. These penalties apply even when there was no intention to mislead. Understanding how HMRC defines carelessness is essential if you want to protect both your company and your personal position.

Careless errors are among the most frequent and costly mistakes directors make, and the tax authority shows little flexibility when reasonable care cannot be demonstrated.

What Counts as a Careless Error

HMRC defines carelessness as a failure to take reasonable care. For company directors, this is a legal responsibility rather than a guideline.

Claiming ignorance or relying entirely on an accountant is rarely accepted as a defence.

-

maintaining accurate, real-time records.

-

Understanding the figures reported in your returns.

-

Ensuring all submitted information reflects the true financial position of the business.

HMRC Directors’ Penalties Explained

-

Careless (Lack of reasonable care)

-

Deliberate (Intentional error)

-

Deliberate and concealed (Intentional error + steps taken to hide it)

Common Careless Mistakes Directors Make

-

Incorrect Dividend Reporting: Failing to distinguish between salary and dividends.

-

Director’s Loan Accounts: Ignoring overdrawn loan accounts or negative balances.

-

Blind Reliance: Assuming your accountant or software will automatically catch every error without your review.

-

Record Keeping: Poor or missing expense receipts.

Reducing Penalties: The Importance of Disclosure

-

Making a prompt, voluntary disclosure before HMRC investigates.

-

Providing full access to records during an inquiry.

-

Responding to correspondence immediately.

How to Manage Penalty Risk

Directors are not powerless. To minimise risk:

-

Review before submitting: Never sign a return you haven’t read and understood.

-

Keep a paper trail: Document the reasoning behind complex tax decisions.

-

Engage proactively: If you find a mistake, tell HMRC immediately.

Take Action Now

HMRC treats carelessness seriously. As a director, you are ultimately responsible for the accuracy of your company’s tax submissions.

Review your director’s loan account, dividend records, and recent returns now. If you identify errors, disclose them voluntarily and promptly. This remains the most effective way to minimise penalties and avoid prolonged tax scrutiny.

If you are unsure about your current tax position, contact our team for a compliance review today.

FAQs

- Can I be penalised for an honest mistake on my tax return?

Yes. The tax authority issues penalties for careless errors, even when unintentional. Incorrect dividend reporting, incomplete expense records, or unverified directors’ loan accounts commonly trigger penalties. Directors remain personally responsible for returns submitted under their name. - How can I reduce a penalty if an error is found?

Make a voluntary disclosure before HMRC contacts you, provide organised records promptly, and cooperate fully during any enquiry. HMRC places strong emphasis on behaviour after an error is identified, and proactive transparency can reduce penalties significantly. - What records show that I took reasonable care?

You should retain dividend vouchers with board minutes, detailed expense receipts, reconciled directors’ loan accounts, and evidence that figures were reviewed before submission. Without clear documentation, HMRC may conclude reasonable care was not taken.