Introduction

Tax relief services can be an essential solution when bills start piling up, especially debts. It can feel like carrying the weight of the world on your shoulders. The thing is, HMRC does not wait around, and letters or phone calls can quickly become overwhelming. It is a lifeline for both individuals and businesses that need guidance and a clear way forward.

What Do Tax Relief Services Mean?

Evidently, the term “tax relief” is about making tax debts more manageable. Clearly, it does not mean that debts disappear overnight, yet these services aim to reduce financial pressure, create an affordable payment structure, and, in some cases, negotiate directly with HMRC to ease the burden.

Tax relief comes in many forms. For one, it may be an extended payment plan. For another, it might involve reducing interest charges. It could even be about restructuring overall debts for some struggling businesses to keep the company afloat.

The Importance of Tax Relief

The impact of tax debts extends beyond your bank account. They jeopardise your sleep and mental health, and they bring constant worry about what comes next. Having access to tax relief services is not just about money; it’s about restoring peace of mind, giving people the confidence to tackle their situation, and helping businesses continue to operate without constant fear of HMRC knocking on the door.

How Tax Relief Works in Practice

At TaxDebts, we believe in practical, human-centred solutions. Tax relief often begins with a free assessment of your situation. Every client is unique. Once we understand the core of the problem, we explore the options available, such as:

- Negotiating Time to Pay arrangements with HMRC.

- Applying for charge reductions if payment delays were for valid reasons.

- Reviewing whether debts are correctly calculated, since errors are more common than people think.

- Offering strategies to ease cash flow so that repayments are affordable.

The real value lies in building a plan that is both achievable and sustainable, not just a quick fix.

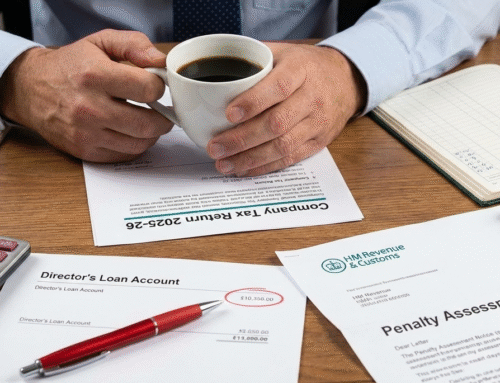

Common Forms of Tax Relief

Tax relief services come in various forms to suit different situations. Relief can include negotiating Time to Pay arrangements, reducing interest charges, correcting errors on tax calculations, or restructuring overall debts. These can ease cash flow and set up tailored repayment plans to keep operations running smoothly.

Some services also offer advice to mitigate future tax risks and improve financial planning. Understanding the different types of tax relief available helps both individuals and businesses choose the right approach and ensures they can tackle HMRC debts without unnecessary stress or disruption.

Support for Businesses

For many businesses, tax relief can mean the difference between closing down and keeping the doors open. When HMRC pressure builds, companies often feel trapped between unmanageable demands and limited cash flow. That’s where tax relief becomes a lifeline.

Rather than letting debts spiral, businesses can work with professionals to negotiate realistic repayment plans with HMRC, reduce charges where possible, and restructure commitments in a way that allows trading to continue. This is not about quick fixes; it’s about protecting jobs and ensuring long-term stability.

In the end, tax relief services are more than just financial tools; they are a way to regain control, reduce stress, and plan for a stable future. Whether you’re an individual struggling with unpaid taxes or a business facing mounting HMRC pressure, seeking professional support can make all the difference.

With the right guidance, you can set up manageable repayment plans, correct errors, and protect your finances or business from unnecessary strain. Don’t wait until debts become unmanageable; taking action early with tax relief services ensures peace of mind and a clearer path forward.