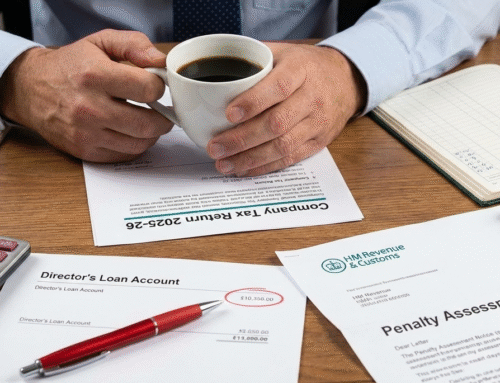

When it comes to being a business owner, routinely making payments to Her Majesty’s Revenue & Customs (HMRC) is a given.

However, it’s not uncommon for businesses to fall behind on payments and amass larger debts, so what can you do? Can you negotiate with HMRC?

In the past HMRC would be allowed greater discretion when collecting debts, allowing them to give some breathing room to smaller businesses going through a tough time.

Unfortunately though, that is now a thing of the past. Inspectors are under increasing pressure to stop any arrears early.

An element of the relationship that remains from the past is that yes, you can still negotiate. If you know how.

Why Negotiating with HMRC is Important

The role of a business owner does include a responsibility to keep HMRC abreast of your dealings, ensure that all taxes are paid, and all paperwork is completed like clockwork. Failure to do so can result in strict penalties being handed out. These can start as a stern letter, and escalate to small fines, before snowballing to significantly larger fines, and even your business ultimately being liquidated.

When you’ve worked years and years to build a business from the ground up, you don’t want to lose everything in weeks because you’ve been foolhardy with your tax payments.

How Can HMRC Help me?

While not as people-focused as they were in the past, HMRC do still appreciate that the business world can be a brutal place. Even the best owners can experience difficulties from time to time, that’s why they are willing to help if they feel you deserve it.

Time to Pay Arrangement

If investigators believe that you are a fiscally responsible owner who cares about your business and its employees; one who has responded appropriately and efficiently with all investigations and outreach, you may deserve assistance. This comes in the form of a Time to Pay arrangement.

Time to Pay is an agreement between a business and HMRC. It allows the business additional time, usually 12 months, in order to repay debts owed.

However, not all Time to Pay agreements are the same. Details of the agreement, such as the amount paid monthly, and the duration are worked out on a case by case basis.

This spreading out of the debt across an additional period of time allows businesses more flexibility to work and come up with the funds without risking the future of the business. We will discuss Time to Pay agreements in more detail later on in this blog.

Can Everybody Negotiate With HMRC?

The option to negotiate with HMRC is not available to everybody. The taxman will only consider you a viable candidate for their Time to Pay arrangement if they are confident in your capability to make the required repayments over the agreed period of time.

You will not be considered viable if you have any of the following:

- Previous history of late or overdue tax returns

- Past failure to cooperate with agreed repayment schemes

- Lack of clear financial information supplied to HMRC in the process

If you find yourself in the position of being rejected by HMRC, or you feel that you need assistance in preparing for the negotiations, seek expert assistance. TaxDebts have an experienced team capable of helping guide you through the entire process and bring you through the other side.

How to Negotiate with HMRC

As with all forms of negotiation, negotiating with HMRC is all about communicating your perspective punctually, effectively, and efficiently.

Something a lot of people don’t understand about negotiating with HMRC is that they don’t really start when you might think they do.

For HMRC, the negotiations start years before you ever need to speak to them about anything in the first place. If you spent years being avoidant, ignoring calls, letters, and emails from HMRC, you have already shown your hand, and it becomes highly unlikely that the taxman will accept you as a legitimate case for help.

Remain active and engaged throughout all your dealings with HMRC. If a director shows that they are on the ball and are active, HMRC will be much more amenable to negotiating to support a responsible business owner.

Negotiating Time to Pay with HMRC

So, you are unable to pay a debt and think you might need to negotiate a Time to Pay agreement with HMRC, what next?

No matter what the scenario, contact the taxman as soon as possible. Get ahead of the issue. It’s much better to broach it with them than let them contact you asking why you haven’t been able to pay.

But don’t go calling too quickly. Preparation is key. There are certain details that you will want to have prepared, to guarantee that you can decisively answer their questions.

A few things you will need to know or have to hand are:

- Total and accurate amount of the bill you are unable to pay

- Your justification for not being able to pay the bill

- Taxpayer/VAT reference number

- Evidence that you are attempting to rectify the issue

- Statistics surrounding business finances (Income and expenditure, assets, cash flow forecast etc.)

- Most importantly – How much you feel that you can pay there and then, and how much time you think will be required to pay the remaining fee off.

It’s vital that you are totally honest during the discussions. At this stage, you won’t gain anything from exaggerating any details. Any deliberate misleading of HMRC can lead to your agreement being cancelled down the line if discovered.

When negotiating with HMRC there are no second tries. There are no bluffs and no poker face is involved. Make sure your points and your proposal are clear, and more importantly, realistic. If you agree to a plan you can’t afford, and default on a payment, your agreement will be void and HMRC will demand the fee in full. Failure to pay will usually lead to swift insolvency against your business.

How Tax Debts Can Assist With HMRC Negotiations

TaxDebts know that serious financial issues can put a strain on you. HMRC breathing down your neck is enough to intimidate anybody.

But don’t worry. Let TaxDebts negotiate with HMRC on your behalf. Through years of tireless work in the field, we have built an excellent reputation with HMRC teams, and have a strong history of successfully negotiating settlements and payment plans in the past.

For further expert advice on how to negotiate with HMRC, contact us directly by dialing 0333 898 0409 and to find out what Tax Debts can do to help you.