In the wake of the COVID-19 pandemic, and with the furlough scheme coming to an end, businesses across the UK are facing serious financial difficulties. This is why the prospect of negotiating Time to Pay with HMRC and receiving that added breathing room is such an attractive option for many.

As a business owner, it is important that you understand the subtleties of Time to Pay (TTP) arrangements; if you qualify, how to apply, what professional guidance can do for the success of your application, and more.

What is an HMRC Time to Pay Arrangement?

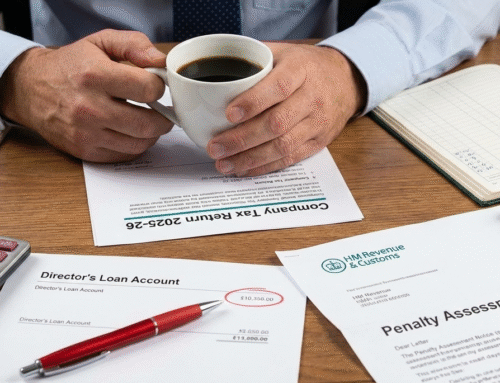

A HMRC Time to Pay Arrangement is an agreement made between a struggling business and the tax office. Time to Pay affords the company up to 12 months extra to repay their debts. This allows businesses additional breathing room against the pressure that can quickly build and overwhelm, particularly when faced with HMRC arrears and the bills are totting up.

Businesses taking part in the TTP scheme can spread their debt repayment over a manageable period of time — thus improving cash flow, and guaranteeing that there is more money available for outgoings. Additionally, the more proactive you are in seeking out a TTP, the less likely it is that HMRC will take enforcement action against you.

Failure to arrange a deal with HMRC could lead to them issuing a winding-up petition against your business. This will result in your company being forced into compulsory liquidation; all assets will be sold off, and you will lose everything you have built.

How to Make a Time to Pay Application

The purpose of Time to Pay is for HMRC to assist businesses faced with an unforeseen/unavoidable financial issue. However, the application hinges on HMRC being satisfied that the firm is indeed struggling and not just attempting to avoid meeting their tax liabilities. Remain patient in the application process, and your business is sure to benefit in the long run.

The most important thing you must do when making a Time to Pay arrangement is to be as proactive as possible. If HMRC reaches out to you about late payments it is already too late and you will have missed your window for support. HMRC wants to help struggling businesses, but to do so they must show the willingness to initiate the contact, to seek help.

Do I qualify for Time to Pay?

Before making an application, it is important that you are clear on whether you qualify in the first place. When considering eligibility for Time to Pay HMRC will consider a number of factors, these include:

- How consistently your business has complied with all tax rules. Any previous late filing of taxes/fines received will show that your company is unreliable, and should not be trusted.

- Have you been proactive in seeking out an agreement?

- What previous experience do you have with TTP arrangements? A business that has taken out an arrangement before will not be disqualified, but will likely be put under additional scrutiny as to why they are applying again.

- How heavily your business was affected by the COVID-19 pandemic.

- How high risk your business is. HMRC are unlikely to offer payment plans to any company considered to be ‘high risk’.

For more information on whether you would qualify for Time to Pay contact TaxDebts today.

Applying for Time to Pay with HMRC

When considering a Time to Pay application, HMRC prefers to be contacted over the phone for efficiency of data collation. You can contact them directly at 0300 200 3835. However, before you pick up the phone it is recommended that you get in touch with a business tax specialist to ensure that your case is as strong as possible.

An insolvency practitioner will be able to assess your specific situation and determine the viability of your application, and the strength of your case. Some factors and information that will need to be considered are:

- How realistic are the terms of the proposal, will the business actually be able to afford to repay?

- What company cash flow figures and forecasts are available to help support the viability of the proposal?

- Are there provisions in place to cut company costs to help adhere to repayment?

- How close to tax arrears are you? The earlier the financial issue is caught, the stronger the case.

It is crucial that you have prepared appropriately for the Time to Pay application — with all important documents on hand. The more efficient you are, the more likely your application will be a success.

Negotiating Time to Pay with HMRC can be a difficult and complicated process. This is why some parties prefer to seek out the assistance of an insolvency practitioner — to ensure that you get the best possible result.

What if HMRC Refuse Time to Pay?

If HMRC refuses your application for a Time to Pay arrangement, it is important if you have not done so already, to seek expert assistance as soon as possible. A licensed insolvency practitioner can conduct an audit of your finances — they can then approach HMRC again with new evidence to show that the business is capable of repaying its debts.

If your application is refused, it is also possible that your expert will suggest a Company Voluntary Arrangement. If negotiating Time to Pay with HMRC is unsuccessful, alternative options such as a CVA may need to be considered. A CVA is an insolvency tool primarily used to restructure a business; including all debts in order to correct any financial difficulties. The time-scale for a CVA typically ranges between 3-5 years.

A CVA can be a useful tool to allow a business to reshape and repay its debts with the aim of remaining in business. It is also possible that the threat of a CVA is enough to force HMRC to consider accepting the initial Time to Pay arrangement. This is because an agreement for repayment in 12 months suits HMRC much more than a more general timescale of 3-5 years. It is also possible during a CVA that the business becomes insolvent, potentially leaving HMRC with nothing to recover.

Need Help with a HMRC Time to Pay Agreement?

Negotiating a Time to Pay Agreement with HMRC can be a difficult time for any business owner. The process can be complicated, and the situation surrounding the application can be stressful. Before you consider picking up the phone and contacting HMRC. speak to Tax Debts, we can undertake a thorough review of your specific circumstance, and outline what options are available to you.

Tax Debts have a very strong working relationship with HMRC, an in-depth knowledge of exactly how it operates, and can use this expertise for your benefit to negotiate with HMRC on your behalf, to ensure the best possible result.

For further help with a HMRC Time to Pay agreement, contact a member of our team today by calling us on 0333 898 0409.