The 1st October 2021 marked the date a creditor can present a compulsory winding up petition without the restrictions put upon them by the pandemic era.

For the last 18 months, companies in financial difficulty were given a reprieve, as creditors were not able to use a winding up petition as the primary means of regaining lost money. That honeymoon period is now over.

It is now essential for businesses to balance their books and ensure they are able to meet all of their obligations. Should this not be possible, their next port of call should be to seek expert guidance on how to manage their finances at the earliest opportunity. Leave it too late, and the company’s future could be at risk.

Before we continue, however, it is important to point out that business landlords are still prohibited from serving a winding up petition until March 2022 — making them the only creditor unable to do so. That being said, if you are in arrears with your landlords, it would still be preferable to sort out your finances before this protection is removed.

Why was the Service of a Winding Up Petition Paused?

The service of winding up petitions was paused in order to provide debt-laden businesses with a modicum of breathing room. It was intended, along with COVID-19 financial support provided by the government, to stop the number of insolvencies in the UK from skyrocketing, thus potentially leaving a huge dent in the nation’s economy for years to come.

The pausing of winding up petitions was introduced in June 2020 when the government unveiled the Corporate Insolvency and Governance Act 2020, one of the most significant alterations to insolvency law the country has seen in decades.

It is believed that this pause to winding up petitions did, ultimately, serve its purpose. Monthly insolvency figures provided by the government back in July 2021 showed that the number of insolvent companies was around 25% lower than at the same time in 2019.

Restrictions against winding up petitions were initially only expected to last until 31st December 2020 before being extended multiple times; to 31st March 2021, then the 30th June, and finally to October.

With businesses continuing to reopen their doors and the nation’s economy slowly showing signs of healing, it was clear that the time had come for further debt accountability to return — and that time is now.

What is the Threshold for a Winding Up Petition?

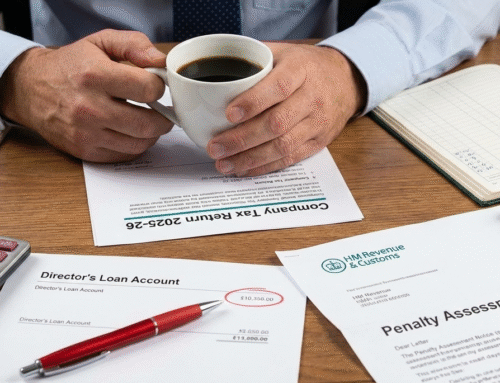

As of October 1st 2021 it is once again possible to present a company with a compulsory winding up petition on the strict basis that they meet a series of conditions. These stem from the total amount owed, a time frame allocated for debtors to pay off the debt, the origin of the debt, and more.

A creditor will need to meet the following conditions in order to present a winding up petition:

- The debt owed must be for a liquidated sum of money, and can under no circumstances be rent or another payment that will be owed under a business’s tenancy agreement.

- Creditors must provide written notice affording the company 21 days before any presentation of a petition. This time is intended for the company presented with the proposal to formulate a plan on how they intend to repay the debt.

- The 21 days period has passed since notice was given and the company has not made a proposal deemed satisfactory to creditors.

- The incumbent debt must stand at a minimum of £10,000. Combined creditor debts can be raised under one petition, and this total sum may exceed this figure.

Winding Up Petition Consequences

There are a variety of possible consequences of a winding up petition that can leave a lasting impact on a business. The most severe consequences can be the significant losses to company finances or reputation, or compulsory liquidation of the business.

A selection of some the core consequences of a winding up petition are as follows:

- Limited Time: A business handed a winding up petition is likely to only have between 4-8 weeks before its fate is decided in court. This means that time is of the essence when it comes to saving the business, putting everybody under immense pressure.

- Assets frozen: A winding up petition being advertised in the London Gazette will lead to all company bank accounts being frozen, stopping any payments in or out.

- Change of Carriage: A change of carriage is a scenario where another party with a legitimate grievance against the business joins in the petition, leading to the business being forced to pay back two or more debtors at the same time.

- Reputational Damage: Clients and consumers can see a winding up petition as a sign that a business is insecure or even untrustworthy and can opt to avoid them.

- Financial Damage: In addition to paying back creditors, businesses can accrue significant financial hits as a result of legal expenses.

For more information about the consequences of a compulsory winding up petition, please read our blog on the subject.

Liquidation of your business represents a disaster for any director or owner, it is the loss of everything that they have worked towards building.

If you do not act quickly against a compulsory winding up petition with a clear, concise plan to turn the tide in your favour and secure a more sustainable future, it could spell the end. Seeking specialist advice on what you can do to aid you in protecting the future of your business.

Do You Need Winding Up Petition Help?

TaxDebts boast a world class team with decades of experience in supporting businesses in compulsory winding up petition cases. We know the process inside and out and can guarantee you the support and knowledge you need to help guide you through what can be a testing time for the company, and for everybody involved in its running and operation.

Receiving a winding up petition can spell disaster for the prolonged future of a business, particularly if not dealt with appropriately and efficiently.

With the brief pause to winding up petitions coming to an end post-pandemic, it is key that all businesses get their affairs in order so they can make sure that they are totally protected against any eventuality.

For further advice on how you can stop a winding up petition, and to discover more about what TaxDebts can do to help, contact a member of our team today by simply dialing 0333 898 0409.