One of the most severe actions a creditor can possibly take against a business, a winding up petition can easily turn into a winding up order, and lead to the quick closure of a business if not handled appropriately and swiftly.

This is why understanding how to stop a winding up petition, what one is, and what actions you can take if you receive it, is pivotal for the protection of your firm’s future.

What Does a Winding Up Petition Mean?

Before we explain how to stop a winding up petition, it is important to detail what one ac2tually is. A winding up petition is a way for creditors to try to recoup lost money owed to them. It is usually seen as a last resort and is not handed out lightly, due to the severe repercussions it can lead to.

Creditors can obtain a winding up petition via the court system when they are owed as little as £750. If somebody can prove that they are owed a certain amount of money and have been unable to retrieve it from another party for a prolonged period of time, the court may issue a winding up petition to request a company repay the debt, in addition to the legal fees. The repayment will have to take place within a certain period of time, or else the debtors’ company will be forced to liquidate, and the recovered proceeds will be used to pay back the debt.

What Should I Do if I Receive a Winding Up Petition?

In most cases a winding up petition will act as a huge red flag that your company is not operating as it should, and needs to act swiftly to avoid liquidation. This often causes a volatile, stressful time within the business, with people not knowing what to do. However, there are things you can do to avoid this.

A winding up petition isn’t going to just go away. If you ignore it, your business will be shuttered. The only thing you can do to save your company is to act quickly and to follow the correct course of action.

Once a petition is served you have seven days before it is made public and posted in the London Gazette, sanctions will follow. This means that you have up to seven days to take stock and re-adjust your business to repay the debt.

The best way to stop the petition being placed in The Gazette would be to seek professional help. An experienced tax professional would be able to come in, assess the situation, and right the ship to stave off liquidation and find a way to repay the debtor.

Can I Stop a Winding Up Petition?

Being handed a winding up petition can, for some businesses, set the ball into motion towards liquidation. but it doesn’t have to. If you are prepared, organised, and informed, you can overcome a tricky situation and come out the other side unscathed, and hopefully more responsible.

There are a few options open to you and things to consider that can buy you more time, make the debt more affordable, and possibly even make it go away entirely.

Communication is Key

The best way to go about things if you’re handed a winding up petition is NOT to isolate yourself from your debtor. You will want to keep an open channel of communication if possible. This will act as a way for you to show your debtor that you are taking the situation seriously and may make them more amenable to finding a compromise to suit both parties.

Pay the Debt Upfront

The simple solution. If you have the means to do so, paying off the debt owed in full (including legal fees) within the allocated period of time is the easiest way of making the petition go away.

If you do it quickly, the petition will be removed from the court and it will not be reported in the London Gazette. However, paying upfront doesn’t always guarantee you’re in the clear.

If the petition is not removed from the court and another company feels that they are also owed money from your business, it could be possible for them to take over the petition, regardless of if you’ve paid off the original debt.

This is called a ‘change of carriage’ and would require you to also repay your outstanding debt to this second company in addition to the first, this process can be done by multiple companies as long as they each have legitimate grievances.

Try to Find an Agreement

If you make it clear to your debtor that you are working as hard as you can to repay the money owed, but are struggling to get it all by the deadline, it may be possible to come to a form of agreement on an informal payment plan.

The most common form of restructuring a business is administration, it grants businesses temporary protection from creditors to come up with a solution to the current predicament.

It should also be remembered that restructuring isn’t a ‘break glass in case of emergency’ solution though. Administration is not an option for any company whose debt has been advertised in the Gazette, and it will only be granted if it is believed that administration could legitimately benefit creditors, and increase the chance of them receiving their money.

Negotiate Formal Payment Terms

A common method of stopping winding up petitions progressing is to formulate a formal payment plan. Company Voluntary Agreements (CVA) were introduced by the UK government to support businesses wanting to repay debts and avoid liquidation.

If the creditor agrees to a CVA your company will be permitted to continue trading to earn money, allowing you to repay the debt. The repayments typically take place once monthly until the debt is paid off, this can take years if the debt accrued is high enough.

For a CVA to be a viable solution, you will need to propose it within the deadline before the debt is advertised in the Gazette, after this point you will be forced to find an alternative solution.

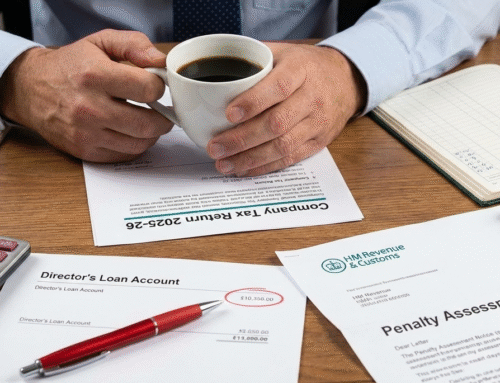

If you are in debt to HMRC, another potential course of action is to agree a Time to Pay Arrangement. This is a method of spreading your payments over a longer period of time to make them more affordable.

Administration

Restructuring a business can be a way for you to re-assess the options ahead and formulate a strategy to tackle the new reality of the business.

The most common form of restructuring a business is administration, it grants businesses temporary protection from creditors to come up with a solution to the current predicament.

It should also be remembered that restructuring isn’t a ‘break glass in case of emergency’ solution though. Administration is not an option for any company whose debt has been advertised in the Gazette, and it will only be granted if it is believed that administration could legitimately benefit creditors, and increase the chance of them receiving their money.

Dispute the Debt

The final, and rarest solution to stopping a winding up petition is to dispute. If you believe that the ordering of a winding up petition is unjust, it may be possible to stop it by receiving an injunction.

HMRC are the organisation responsible for calculating and assessing the situation to provide evidence of the legitimacy of the application for a winding up petition, and they very rarely make errors. But in all aspects of life, mistakes can happen.

So if you have received a winding up petition that you disagree with, and you believe that you can provide proper evidence to support your view, you could have the petition dropped completely.

If you believe the winding up petition to be unjust, seek specialist advice. They will be able to assess the situation without bias and establish whether you truly have a case to dispute the debt.

How Can Tax Debts Help?

A winding up petition could be a fatal blow to your company if it isn’t handled thoroughly, responsibly, and efficiently.

For further expert advice on how to stop a winding up petition, and find out what Tax Debts can do to help you, get in touch today by calling 0333 898 0409.